Daily News

CBI Investigates the Mysterious Death of Aqil Akhtar, Son of Former DGP

Panchkula is in the news due to the suspicious death of Aqil Akhtar.

CBI investigates the mysterious death of Aqil Akhtar in Panchkula, a case that has shocked many people across India. The 35-year-old man was found unconscious at his home in MDC, Sector-4, on October 16. His sudden death has raised many questions. Therefore, the Central Bureau of Investigation (CBI), India’s premier investigating agency, has now taken charge of this sensitive case.

On Friday evening, CBI officers visited the residence of Aqil’s father, Mohammad Mustafa, a former Director General of Police (DGP) in Punjab. The investigators have started questioning people close to Aqil. These include domestic helpers, workers, and neighbors who might have information about the incident. Moreover, the CBI team is working alongside the Panchkula police’s Special Investigation Team (SIT) and forensic experts to gather crucial evidence.

The Haryana government recommended the CBI takeover on October 23, just days after Aqil’s death. As a result, the central agency now controls every aspect of the investigation. Meanwhile, they are exploring multiple theories about what might have caused his death. The local police had already begun some groundwork before the case transfer.

Importantly, officers have seized several items from Aqil’s home. These include his personal diary, mobile phone, and laptop. Furthermore, handwriting experts will analyze the diary to verify its authenticity. The diary contains entries that match topics Aqil discussed in a viral video he posted on August 27, just weeks before his death.

In that video, Aqil made serious allegations against his own family members. He claimed his mother, sister, and relatives wanted to harm him. Additionally, he expressed fear that they might falsely accuse him of crimes he did not commit. These claims shocked viewers and quickly spread across social media platforms.

Following the video, authorities filed a First Information Report (FIR) against Aqil’s family members. However, they denied all accusations. Instead, they stated that Aqil struggled with drug addiction. This adds another layer of complexity to an already complicated case. In fact, Punjab has seen many similar cases where family disputes intersect with substance abuse problems.

The case highlights growing concerns about crime in Punjab and the Chandigarh Tricity area. Recently, several investigative agencies have increased their focus on this region. Consequently, cases involving family conflicts, drugs, and suspicious deaths receive more attention than ever before.

The CBI officers are now preparing a list of key witnesses for detailed interrogation. Soon, these individuals will receive a summons to appear at the CBI office in Sector 30, Chandigarh. The investigators want to understand the timeline of events leading to Aqil’s death. They are also examining his social connections, financial records, and communication history.

Forensic teams are conducting detailed analysis of all evidence collected from the scene. This includes toxicology reports, post-mortem findings, and digital forensics of his electronic devices. Such comprehensive investigation methods help ensure no detail goes unnoticed.

The community and Aqil’s extended family are desperately waiting for answers. Many people knew Aqil personally and find it hard to believe what happened. Meanwhile, the case serves as a stark reminder of how family relationships can sometimes turn dangerous, especially when mixed with substance abuse issues.

The investigation also shows why different law enforcement agencies must work together effectively. The cooperation between CBI, local police, and forensic teams is essential for solving complex cases like this one. Without such teamwork, finding the truth becomes much harder.

As days pass, more evidence continues to emerge. The CBI is methodically piecing together what happened on that fateful day in October. They are also investigating events from months before Aqil’s death to understand the full picture.

Legal experts say cases involving prominent families often face extra scrutiny. Since Aqil’s father served as Punjab’s DGP, this investigation carries additional public interest. People want to ensure that justice prevails regardless of anyone’s status or position.

In conclusion, CBI investigates the mysterious death of Aqil Akhtar with determination to uncover the truth. The agency’s thorough approach gives hope that answers will come soon. Ultimately, everyone seeks justice for Aqil and closure for all those affected by this tragedy. The case remains under active investigation, and authorities promise to leave no stone unturned in their search for truth.

Daily News

Enzo Maresca Leaves Chelsea After Manchester City Talks and Breakdown in Relations

Chelsea Football Club parted ways with head coach Enzo Maresca on Thursday, bringing an end to his 18-month tenure at Stamford Bridge. The Italian manager’s departure comes after he informed club officials about holding talks regarding the Manchester City manager position. Moreover, his relationship with Chelsea’s leadership had deteriorated significantly in recent weeks.

Why Did Maresca Leave?

The primary reason for his exit involves a breakdown in relations with Chelsea’s hierarchy. Sources reveal that Maresca told club bosses twice in late October, and again in December, that he had discussed replacing Pep Guardiola at Manchester City. Furthermore, he attempted to use interest from Juventus and City as leverage for a new contract. However, Chelsea rejected this approach and refused to enter negotiations.

Recent Struggles and Tensions

Chelsea’s form had declined significantly before Maresca’s departure. The team won only one of their last seven Premier League games, dropping to fifth place. Additionally, they drew 2-2 with Bournemouth on Tuesday, which led to fans booing the team off the pitch.

| Maresca’s Chelsea Record | Details |

|---|---|

| Time at club | 18 months (July 2024 – January 2026) |

| Trophies won | UEFA Conference League, FIFA Club World Cup |

| Contract length | Until June 2029 |

| Final league position | Fifth place |

| Recent form | 1 win in last 7 games |

Key Issues Behind the Scenes

Several problems contributed to Maresca’s exit:

- Medical Department Clashes: Maresca wanted more freedom to ignore medical advice on player workloads. Chelsea, however, protects players through strict rotation policies to prevent injuries.

- Public Criticism: He made cryptic comments about experiencing his “worst 48 hours” at the club after beating Everton in December. These remarks surprised his own staff members.

- Player Management: The club became concerned when captain Reece James played three full games in one week despite his injury history.

- Fan Reaction: Supporters chanted “You don’t know what you’re doing” when he substituted Cole Palmer against Bournemouth.

Maresca’s Achievements

Despite the turbulent ending, Maresca achieved notable success at Chelsea. He guided the club back to Champions League football by finishing fourth in his debut season. In addition, he won both the Conference League and the inaugural Club World Cup.

What Happens Next?

Chelsea face Manchester City on Sunday without a confirmed manager. Under-21s head coach Calum McFarlane will handle media duties on Friday. Meanwhile, Liam Rosenior, who currently manages Strasbourg (Chelsea’s partner club), emerges as a leading candidate for the permanent position.

The club needs to act quickly as they still compete in four competitions. Consequently, they may appoint an interim manager while searching for a long-term solution.

Enzo Maresca becomes Chelsea’s fifth permanent head coach to leave since Todd Boehly and Clearlake Capital bought the club in May 2022. His departure highlights ongoing instability at Stamford Bridge despite recent trophy success.

Daily News

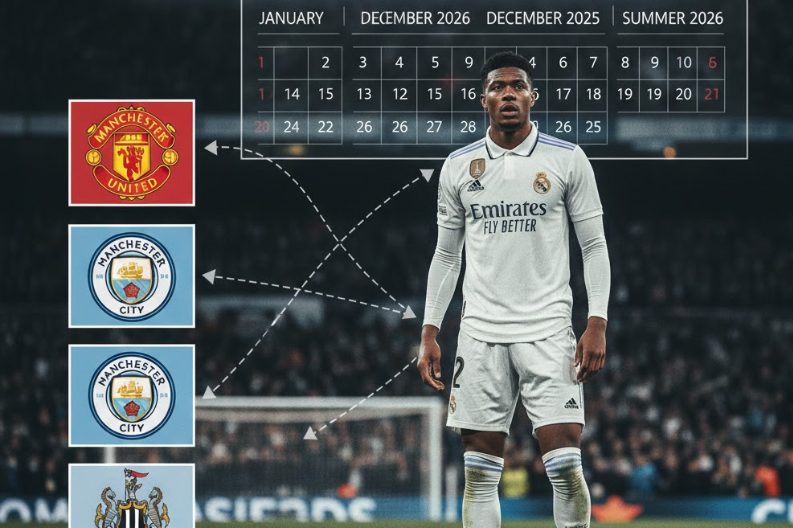

Alexander Arnold’s Real Madrid Future in Doubt as Premier League Clubs Circle

The football world is buzzing with speculation about Alexander Arnold and his challenging time at Real Madrid. The English defender made a controversial move from Liverpool to the Spanish giants last summer. However, things haven’t gone as planned for the 27-year-old.

Since joining Real Madrid, Alexander-Arnold has struggled to find his rhythm. He has made only 11 appearances across all competitions. Moreover, a quadriceps injury in December has sidelined him for several months. This lack of playing time has raised questions about his future at the Bernabéu.

Current Situation at Real Madrid

Several factors are contributing to the uncertainty:

- Limited game time with just 11 matches played

- Recent injury keeping him out for two months

- Difficulty adapting to Spanish football

- One assist recorded so far this season

Despite these challenges, both Alexander-Arnold and Real Madrid remain committed to each other. The player wants to stay and prove himself. Similarly, the club believes he needs more time to adapt.

Premier League Interest Growing

Nevertheless, three English clubs are monitoring the situation closely. Manchester United, Manchester City, and Newcastle United are all considering making offers. Reports suggest they might bid around €40 million for the defender.

For Manchester United, this move would be particularly controversial. Alexander-Arnold spent his entire career at Liverpool before joining Madrid. A transfer to United would cross one of football’s biggest rivalries.

Meanwhile, Newcastle United sees him as a valuable addition to their squad. They currently sit tenth in the Premier League and want to strengthen their defense.

Real Madrid’s Position

| Club Stance | Details |

|---|---|

| Current valuation | €40 million offers considered insufficient |

| Contract length | Runs until summer 2031 |

| Selling intention | No plans to let him leave |

| Club confidence | Believes in his potential |

Real Madrid paid a small transfer fee to Liverpool last summer. Any sale would generate significant profit for them. However, they have no intention of selling at this point.

What Happens Next?

The January transfer window has opened, but no immediate moves are expected. Instead, the summer of 2026 could be crucial. By then, Alexander Arnold will have had more time to prove himself in Spain. If things don’t improve, those Premier League clubs might return with stronger offers.

For now, everyone waits to see if the talented defender can overcome his struggles and establish himself at Real Madrid.

Daily News

Aaron Hardie Smashes 94 as Perth Scorchers End Hurricanes’ Home Winning Streak

Perth Scorchers delivered a powerful performance at Bellerive Oval, with aaron hardie playing a starring role alongside captain Mitchell Marsh. The duo put on a record-breaking display that ended Hobart Hurricanes’ impressive nine-match winning streak at home. Consequently, the Scorchers moved up to third place on the BBL points table.

Record-Breaking Partnership

Mitchell Marsh scored 102 runs off 58 balls, while Aaron Hardie remained unbeaten on 94 from just 43 deliveries. Together, they created the highest third-wicket partnership in BBL history with 164 runs. Furthermore, their explosive batting powered Perth to a massive total of 229 for 3 wickets.

Match Highlights

| Team | Score | Result |

|---|---|---|

| Perth Scorchers | 3-229 | Won by 40 runs |

| Hobart Hurricanes | 9-189 | Lost |

The turning point came during the final 10 overs. Perth scored an incredible 149 runs in that period. Additionally, they added 38 runs during the Power Surge overs, which completely changed the game’s momentum.

Hardie’s Explosive Performance

Aaron Hardie particularly dominated Chris Jordan in the 12th over. He smashed four boundaries and one six, helping his team collect 26 runs from that over alone. His innings included five massive sixes and showcased his ability to accelerate when needed most.

Mitchell Marsh praised Hardie after the match, saying he deserved the player of the match award. However, Marsh himself received the honor for his century.

Hurricanes’ Chase Falls Short

Despite a strong effort, Hobart Hurricanes couldn’t keep up with the required run rate. They lost opener Mitchell Owen cheaply once again. Subsequently, they lost both openers during the powerplay, putting them under immediate pressure.

Nikhil Chaudhary scored 31 off 15 balls, while captain Matthew Wade added 29 from 14 deliveries. The pair put together a fighting 56-run partnership. Nevertheless, their dismissals in quick succession ended any hopes of a comeback.

Key Factors in Scorchers’ Victory

- Marsh’s second BBL century (102 off 58 balls)

- Hardie’s unbeaten 94 off 43 balls

- Record 164-run partnership for third wicket

- 149 runs scored in final 10 overs

- Disciplined bowling in crucial moments

Impact on Tournament Standings

This victory gave Perth Scorchers their second consecutive big win. Moreover, it boosted their confidence as they secured third position on the table midway through the season. Their record now stands at three wins and two losses.

Meanwhile, Hobart Hurricanes remain second on the points table despite this loss. Their record of four wins and two losses still keeps them in strong contention.

The match proved that aaron hardie has become a crucial player for the Scorchers. His ability to finish innings with such power makes Perth a dangerous team heading into the second half of the tournament.

-

City Guide3 years ago

City Guide3 years ago3B2 Mohali Market Shops: Discover 44 Hidden Gems

-

Entertainment3 years ago

Entertainment3 years agoTop 15 Punjabi Models – Male and Female List

-

Entertainment3 years ago

Entertainment3 years agoTop 11 Punjabi Comedians of All Time

-

Jobs4 years ago

Jobs4 years agoTop 20 IT Companies in Mohali

-

Food4 years ago

Food4 years ago11 Best Restaurants in Mohali You Must Visit

-

Food3 years ago

Food3 years agoTop 15 Cafes in Mohali you must visit

-

Property2 years ago

Property2 years agoWho Lives In Homeland Mohali: Punjabi Celebrities, Business People…

-

Education2 years ago

Education2 years ago10 Famous Punjabi Writers With A Great Impact On The Literary World