Daily News

What Is an AI Bubble? A Deep, Clear Explanation

Artificial Intelligence (AI) has transformed from a futuristic dream into a booming global industry. Trillion-dollar valuations, skyrocketing chip demand, and rapidly expanding data centers have convinced many that AI will change the world. And in many ways, it will. But beneath the excitement, the rapid pace of investment and financial engineering has raised an important question: Are we living through an AI Bubble?

Just like the dot-com era of 1999 or the US housing bubble of 2008, an “AI Bubble” refers to a dramatic rise in valuations, investments, and expectations-far beyond what real-world fundamentals justify. When these expectations eventually confront reality, the bubble risks bursting.

This article explains what an AI bubble is, how it forms, why it matters, and how investors and industries should view it.

1. Understanding the Core Idea of a Bubble

A “bubble” is an economic condition where asset prices rise sharply because of hype, momentum, and optimism-rather than actual performance and revenue.

In the context of AI:

- Companies are investing heavily in computing power and data centers.

- Investors are pouring money into AI startups at record valuations.

- Tech giants are spending tens of billions on chips, servers, and software.

- Everyone assumes that AI will soon generate massive profits.

A bubble forms when expectations grow much faster than actual, sustainable earnings.

In other words:

A bubble is created when we assume infinite growth based on finite evidence.

2. Why AI Is Attracting Trillions of Dollars

Before calling it a bubble, we must understand why this technology attracts so much money.

AI promises:

- Faster automation

- Better productivity

- New business models

- Breakthroughs in medicine, education, finance, robotics, and more

- Massive time and cost savings for enterprises

Global companies do not want to miss out on a technological shift that could determine the next generation of winners in the economy.

There’s nothing wrong with this. Innovation requires investment.

The issue begins when these investments turn speculative, detached from realistic outcomes.

3. What Creates an AI Bubble?

a. Exponential Investment vs. Slow Monetization

AI models (LLMs, diffusion models, robotics brains) need:

- Immense GPU power

- Large data centers

- Cheap electricity

- High-bandwidth networking

- Engineering teams

- Safety teams

- Product teams

Yet, despite billions spent, AI revenue is still small. Except for a few giants like Google and Microsoft, most companies haven’t found a profitable business model.

If expenses rise faster than revenue, valuations can become artificially inflated.

b. Circular Financing

In a healthy economy, money flows like this:

Investor → Company → Revenue → Profit

But in bubbles, the flow becomes circular:

Investor → Company A → Company B → Company A

Example pattern:

Company A invests in Company B → Company B uses the funds to buy Company A’s products → Company A’s revenue goes up → valuation goes up → investors put more money.

It creates an illusion of demand-when in reality, the cash keeps cycling inside the same loop.

c. Hidden Debt and Financial Engineering

Some companies don’t want to show massive AI-related debt on their balance sheets. So they create:

- SPVs (Special Purpose Vehicles)

- Leasing structures

- Off-balance-sheet borrowing

- Vendor financing arrangements

This makes their main company appear financially healthy, even when huge risks are quietly accumulating elsewhere.

This is similar to the 2008 housing bubble, where mortgage risks were hidden inside complex derivatives.

d. GPU and Data Center Mania

An AI model isn’t just software-it lives inside expensive data centers packed with GPUs. The cost of building these facilities has exploded.

But here is the issue:

- GPUs depreciate quickly

- New generations release faster than before

- The hardware becomes obsolete

- Data center rental rates fluctuate

- Electricity and cooling costs rise

- AI demand is not guaranteed

If the business model does not justify massive capex, the investment becomes risky.

4. Fake Demand and Overreaction to Geopolitics

AI chips also became expensive because geopolitics created artificial scarcity. Restrictions on selling high-end chips to countries like China created a “shortage premium.” Companies started hoarding chips, not because they needed them immediately, but out of fear of missing out.

This artificial demand can collapse quickly once supply stabilizes.

5. AI Hype Across Non-Tech Industries

In the dot-com era, every company rushed to add “.com” to their name.

Today, something similar is happening:

- AI toothbrush

- AI washing machine

- AI refrigerator

- AI hair dryer

- AI fan

- AI cooker

- AI helmet

- AI vacuum cleaner

Most of these “AI-enabled” products do not provide any meaningful intelligence. But companies do this to attract investor money and media attention.

When hype becomes a strategy, a bubble is already forming.

6. Historical Parallels: How Bubbles Usually Work

Dot-Com Bubble (2000):

- Companies grew without revenue

- IPOs doubled on listing day

- “Internet will change everything”

- But most firms had no profits

- Bubble burst when investors demanded real cashflows

Housing Bubble (2008):

- Excessive borrowing

- Hidden risks

- Overconfidence that prices will always rise

- Collapse triggered a global recession

AI Bubble Today:

- Massive capex

- Hidden debt

- Unrealistic expectations

- Companies using AI tag for hype

- Concern that revenue may not catch up soon

7. Is AI Itself a Bubble? Absolutely Not.

Artificial intelligence is real. It is transformative, and it’s here to stay.

But the financial ecosystem around AI may be inflated.

The internet survived the 2000 crash.

Housing still exists after 2008.

But the companies built on unrealistic promises disappeared.

Similarly, AI will remain essential for the next 50+ years-but many AI businesses may not survive the financial correction.

8. When Can an AI Bubble Burst?

Predicting exact timing is impossible.

But bubbles usually burst when:

- interest rates rise

- profitability lags

- capital becomes expensive

- debt accumulates

- growth expectations fail

- competitive pressure increases

- investors look for safer opportunities

If companies cannot turn today’s multi-billion-dollar investments into sustainable revenues, correction becomes inevitable.

9. What Happens If the AI Bubble Bursts?

Short-term impact:

- Stock market correction

- Valuations of AI startups collapse

- GPU and data center prices drop

- Over-leveraged firms face bankruptcy

- Investors lose money on speculative bets

- Hiring slows across tech sectors

Long-term positive impact:

- Weak, overhyped companies disappear

- Strong products survive

- Innovation becomes more disciplined

- Infrastructure becomes cheaper

- AI becomes more accessible

- Industry stabilizes

- Real business models mature

Bubbles clean the ecosystem and leave behind only what truly works.

10. Will AI Still Grow After a Bubble? Yes-Even Faster.

A bubble does not destroy technology. It only destroys bad investments.

After the dot-com crash, the internet entered its golden period.

>After the crypto crashes, blockchain matured and became more regulated.

>After solar energy crashes, renewable companies finally became profitable.

AI will follow the same pattern:

Temporary hype → Bubble → Correction → Sustainable long-term growth

Final Thoughts

An AI Bubble forms when optimism outpaces logic, financial engineering hides risk, and everyone assumes growth will continue forever. But AI itself is not the bubble. The bubble is the money, debt, valuation, and expectation built around the technology.

AI will change the world. But the journey may include a financial reset-one that separates hype from real innovation.

True revolutions don’t collapse after a bubble.

They only get stronger.

Daily News

Enzo Maresca Leaves Chelsea After Manchester City Talks and Breakdown in Relations

Chelsea Football Club parted ways with head coach Enzo Maresca on Thursday, bringing an end to his 18-month tenure at Stamford Bridge. The Italian manager’s departure comes after he informed club officials about holding talks regarding the Manchester City manager position. Moreover, his relationship with Chelsea’s leadership had deteriorated significantly in recent weeks.

Why Did Maresca Leave?

The primary reason for his exit involves a breakdown in relations with Chelsea’s hierarchy. Sources reveal that Maresca told club bosses twice in late October, and again in December, that he had discussed replacing Pep Guardiola at Manchester City. Furthermore, he attempted to use interest from Juventus and City as leverage for a new contract. However, Chelsea rejected this approach and refused to enter negotiations.

Recent Struggles and Tensions

Chelsea’s form had declined significantly before Maresca’s departure. The team won only one of their last seven Premier League games, dropping to fifth place. Additionally, they drew 2-2 with Bournemouth on Tuesday, which led to fans booing the team off the pitch.

| Maresca’s Chelsea Record | Details |

|---|---|

| Time at club | 18 months (July 2024 – January 2026) |

| Trophies won | UEFA Conference League, FIFA Club World Cup |

| Contract length | Until June 2029 |

| Final league position | Fifth place |

| Recent form | 1 win in last 7 games |

Key Issues Behind the Scenes

Several problems contributed to Maresca’s exit:

- Medical Department Clashes: Maresca wanted more freedom to ignore medical advice on player workloads. Chelsea, however, protects players through strict rotation policies to prevent injuries.

- Public Criticism: He made cryptic comments about experiencing his “worst 48 hours” at the club after beating Everton in December. These remarks surprised his own staff members.

- Player Management: The club became concerned when captain Reece James played three full games in one week despite his injury history.

- Fan Reaction: Supporters chanted “You don’t know what you’re doing” when he substituted Cole Palmer against Bournemouth.

Maresca’s Achievements

Despite the turbulent ending, Maresca achieved notable success at Chelsea. He guided the club back to Champions League football by finishing fourth in his debut season. In addition, he won both the Conference League and the inaugural Club World Cup.

What Happens Next?

Chelsea face Manchester City on Sunday without a confirmed manager. Under-21s head coach Calum McFarlane will handle media duties on Friday. Meanwhile, Liam Rosenior, who currently manages Strasbourg (Chelsea’s partner club), emerges as a leading candidate for the permanent position.

The club needs to act quickly as they still compete in four competitions. Consequently, they may appoint an interim manager while searching for a long-term solution.

Enzo Maresca becomes Chelsea’s fifth permanent head coach to leave since Todd Boehly and Clearlake Capital bought the club in May 2022. His departure highlights ongoing instability at Stamford Bridge despite recent trophy success.

Daily News

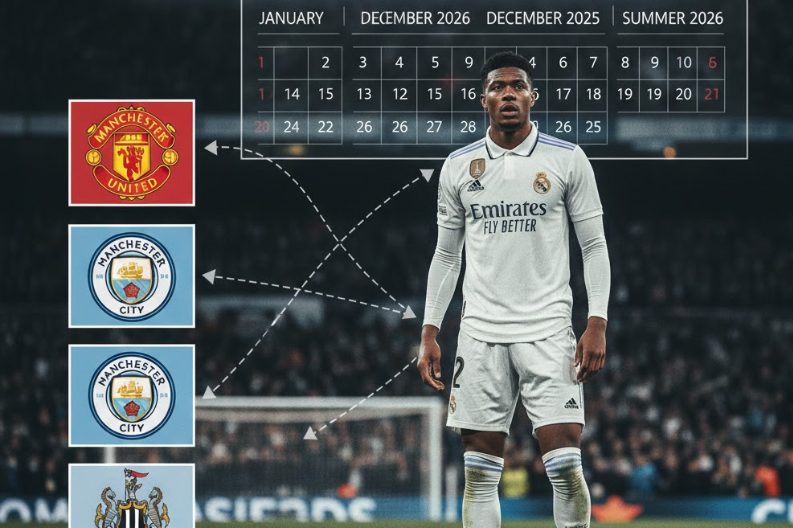

Alexander Arnold’s Real Madrid Future in Doubt as Premier League Clubs Circle

The football world is buzzing with speculation about Alexander Arnold and his challenging time at Real Madrid. The English defender made a controversial move from Liverpool to the Spanish giants last summer. However, things haven’t gone as planned for the 27-year-old.

Since joining Real Madrid, Alexander-Arnold has struggled to find his rhythm. He has made only 11 appearances across all competitions. Moreover, a quadriceps injury in December has sidelined him for several months. This lack of playing time has raised questions about his future at the Bernabéu.

Current Situation at Real Madrid

Several factors are contributing to the uncertainty:

- Limited game time with just 11 matches played

- Recent injury keeping him out for two months

- Difficulty adapting to Spanish football

- One assist recorded so far this season

Despite these challenges, both Alexander-Arnold and Real Madrid remain committed to each other. The player wants to stay and prove himself. Similarly, the club believes he needs more time to adapt.

Premier League Interest Growing

Nevertheless, three English clubs are monitoring the situation closely. Manchester United, Manchester City, and Newcastle United are all considering making offers. Reports suggest they might bid around €40 million for the defender.

For Manchester United, this move would be particularly controversial. Alexander-Arnold spent his entire career at Liverpool before joining Madrid. A transfer to United would cross one of football’s biggest rivalries.

Meanwhile, Newcastle United sees him as a valuable addition to their squad. They currently sit tenth in the Premier League and want to strengthen their defense.

Real Madrid’s Position

| Club Stance | Details |

|---|---|

| Current valuation | €40 million offers considered insufficient |

| Contract length | Runs until summer 2031 |

| Selling intention | No plans to let him leave |

| Club confidence | Believes in his potential |

Real Madrid paid a small transfer fee to Liverpool last summer. Any sale would generate significant profit for them. However, they have no intention of selling at this point.

What Happens Next?

The January transfer window has opened, but no immediate moves are expected. Instead, the summer of 2026 could be crucial. By then, Alexander Arnold will have had more time to prove himself in Spain. If things don’t improve, those Premier League clubs might return with stronger offers.

For now, everyone waits to see if the talented defender can overcome his struggles and establish himself at Real Madrid.

Daily News

Aaron Hardie Smashes 94 as Perth Scorchers End Hurricanes’ Home Winning Streak

Perth Scorchers delivered a powerful performance at Bellerive Oval, with aaron hardie playing a starring role alongside captain Mitchell Marsh. The duo put on a record-breaking display that ended Hobart Hurricanes’ impressive nine-match winning streak at home. Consequently, the Scorchers moved up to third place on the BBL points table.

Record-Breaking Partnership

Mitchell Marsh scored 102 runs off 58 balls, while Aaron Hardie remained unbeaten on 94 from just 43 deliveries. Together, they created the highest third-wicket partnership in BBL history with 164 runs. Furthermore, their explosive batting powered Perth to a massive total of 229 for 3 wickets.

Match Highlights

| Team | Score | Result |

|---|---|---|

| Perth Scorchers | 3-229 | Won by 40 runs |

| Hobart Hurricanes | 9-189 | Lost |

The turning point came during the final 10 overs. Perth scored an incredible 149 runs in that period. Additionally, they added 38 runs during the Power Surge overs, which completely changed the game’s momentum.

Hardie’s Explosive Performance

Aaron Hardie particularly dominated Chris Jordan in the 12th over. He smashed four boundaries and one six, helping his team collect 26 runs from that over alone. His innings included five massive sixes and showcased his ability to accelerate when needed most.

Mitchell Marsh praised Hardie after the match, saying he deserved the player of the match award. However, Marsh himself received the honor for his century.

Hurricanes’ Chase Falls Short

Despite a strong effort, Hobart Hurricanes couldn’t keep up with the required run rate. They lost opener Mitchell Owen cheaply once again. Subsequently, they lost both openers during the powerplay, putting them under immediate pressure.

Nikhil Chaudhary scored 31 off 15 balls, while captain Matthew Wade added 29 from 14 deliveries. The pair put together a fighting 56-run partnership. Nevertheless, their dismissals in quick succession ended any hopes of a comeback.

Key Factors in Scorchers’ Victory

- Marsh’s second BBL century (102 off 58 balls)

- Hardie’s unbeaten 94 off 43 balls

- Record 164-run partnership for third wicket

- 149 runs scored in final 10 overs

- Disciplined bowling in crucial moments

Impact on Tournament Standings

This victory gave Perth Scorchers their second consecutive big win. Moreover, it boosted their confidence as they secured third position on the table midway through the season. Their record now stands at three wins and two losses.

Meanwhile, Hobart Hurricanes remain second on the points table despite this loss. Their record of four wins and two losses still keeps them in strong contention.

The match proved that aaron hardie has become a crucial player for the Scorchers. His ability to finish innings with such power makes Perth a dangerous team heading into the second half of the tournament.

-

Entertainment3 years ago

Entertainment3 years agoTop 15 Punjabi Models – Male and Female List

-

City Guide3 years ago

City Guide3 years ago3B2 Mohali Market Shops: Discover 44 Hidden Gems

-

Entertainment3 years ago

Entertainment3 years agoTop 11 Punjabi Comedians of All Time

-

Jobs4 years ago

Jobs4 years agoTop 20 IT Companies in Mohali

-

Food4 years ago

Food4 years ago11 Best Restaurants in Mohali You Must Visit

-

Food3 years ago

Food3 years agoTop 15 Cafes in Mohali you must visit

-

Property2 years ago

Property2 years agoWho Lives In Homeland Mohali: Punjabi Celebrities, Business People…

-

Education2 years ago

Education2 years ago10 Famous Punjabi Writers With A Great Impact On The Literary World