Daily News

Eight People Arrested in Huge Rs1.75 Crore Cyber Fraud in Panchkula

On July 31, 2024, a man from Panchkula reported a serious case of cyber fraud to the police.

In a shocking case of financial deception, eight people arrested in huge Rs1.75 crore Cyber Fraud have brought attention to the growing threat of online scams in Panchkula and across India. On July 31, 2024, a local man filed a complaint after losing ₹1.75 crore to a fraudulent online investment scheme. The scam began on July 5, when he clicked on a Facebook advertisement claiming to offer stock market tips. The ad redirected him to a WhatsApp link that promised to double his investment. Trusting the scheme, he deposited money, only to realize later that he had been tricked.

The police immediately launched an investigation and registered a case under several sections of the Bharatiya Nyaya Sanhita (BNS) dealing with financial fraud. Officer Bhup Singh, who leads the probe, traced ₹1.5 crore of the stolen amount to the bank account of a man named Chetan. Investigators later found that Chetan’s account also contained an additional ₹3.5 crore connected to other cyber crimes.

So far, eight suspects have been arrested in the case, and the police believe more people are involved. Authorities are now examining other bank accounts linked to Chetan to uncover the full extent of the scam. They expect to make additional arrests soon.

According to police data, cyber fraud cases in Panchkula have surged by nearly 40% in the past year. Many scams involve fake investment plans, online trading advertisements, and phishing links sent through social media or messaging apps. These tactics are designed to look genuine but trick people into transferring their savings to fraudsters.

To tackle this growing problem, the government has set up a Cyber Crime Police Station in Panchkula. This unit focuses exclusively on digital crimes and coordinates with national cybercrime agencies. Officers are also working to freeze suspicious accounts, recover lost funds, and create awareness campaigns to educate citizens.

Experts say that online scams often target middle-class investors looking for quick profits. The victims usually fall prey to promises of high returns or limited-time offers. Cybercriminals take advantage of social media’s reach to lure unsuspecting users. Once victims transfer the money, investigators find it difficult to track because scammers move it through multiple fake accounts and digital wallets.

Police officials have urged the public to stay alert and follow some basic safety rules:

- Never trust advertisements that guarantee quick profits.

- Avoid clicking unknown links on Facebook, Instagram, or WhatsApp.

- Verify all investment offers through official company websites or registered brokers.

- Report any suspicious messages or phone calls immediately to the police or cyber helpline (1930).

This incident is part of a wider national trend where cyber frauds are rising rapidly. Reports suggest that thousands of Indians lose hundreds of crores every year to such scams. In many cases, the fraudsters operate from other states or even foreign countries, using technology to hide their identities.

Officer Bhup Singh stated that the team’s priority is to ensure that victims get justice and to prevent similar crimes in the future. The police are collaborating with banks and digital payment platforms to trace suspicious transactions faster.

In conclusion, the eight people arrested in huge Rs1.75 crore Cyber Fraud case highlights the urgent need for digital awareness and caution while investing online. While the arrests mark a significant achievement for law enforcement, the battle against cybercrime continues. With stronger laws, public vigilance, and faster investigations, society can protect itself from the growing web of online frauds.

Daily News

Enzo Maresca Leaves Chelsea After Manchester City Talks and Breakdown in Relations

Chelsea Football Club parted ways with head coach Enzo Maresca on Thursday, bringing an end to his 18-month tenure at Stamford Bridge. The Italian manager’s departure comes after he informed club officials about holding talks regarding the Manchester City manager position. Moreover, his relationship with Chelsea’s leadership had deteriorated significantly in recent weeks.

Why Did Maresca Leave?

The primary reason for his exit involves a breakdown in relations with Chelsea’s hierarchy. Sources reveal that Maresca told club bosses twice in late October, and again in December, that he had discussed replacing Pep Guardiola at Manchester City. Furthermore, he attempted to use interest from Juventus and City as leverage for a new contract. However, Chelsea rejected this approach and refused to enter negotiations.

Recent Struggles and Tensions

Chelsea’s form had declined significantly before Maresca’s departure. The team won only one of their last seven Premier League games, dropping to fifth place. Additionally, they drew 2-2 with Bournemouth on Tuesday, which led to fans booing the team off the pitch.

| Maresca’s Chelsea Record | Details |

|---|---|

| Time at club | 18 months (July 2024 – January 2026) |

| Trophies won | UEFA Conference League, FIFA Club World Cup |

| Contract length | Until June 2029 |

| Final league position | Fifth place |

| Recent form | 1 win in last 7 games |

Key Issues Behind the Scenes

Several problems contributed to Maresca’s exit:

- Medical Department Clashes: Maresca wanted more freedom to ignore medical advice on player workloads. Chelsea, however, protects players through strict rotation policies to prevent injuries.

- Public Criticism: He made cryptic comments about experiencing his “worst 48 hours” at the club after beating Everton in December. These remarks surprised his own staff members.

- Player Management: The club became concerned when captain Reece James played three full games in one week despite his injury history.

- Fan Reaction: Supporters chanted “You don’t know what you’re doing” when he substituted Cole Palmer against Bournemouth.

Maresca’s Achievements

Despite the turbulent ending, Maresca achieved notable success at Chelsea. He guided the club back to Champions League football by finishing fourth in his debut season. In addition, he won both the Conference League and the inaugural Club World Cup.

What Happens Next?

Chelsea face Manchester City on Sunday without a confirmed manager. Under-21s head coach Calum McFarlane will handle media duties on Friday. Meanwhile, Liam Rosenior, who currently manages Strasbourg (Chelsea’s partner club), emerges as a leading candidate for the permanent position.

The club needs to act quickly as they still compete in four competitions. Consequently, they may appoint an interim manager while searching for a long-term solution.

Enzo Maresca becomes Chelsea’s fifth permanent head coach to leave since Todd Boehly and Clearlake Capital bought the club in May 2022. His departure highlights ongoing instability at Stamford Bridge despite recent trophy success.

Daily News

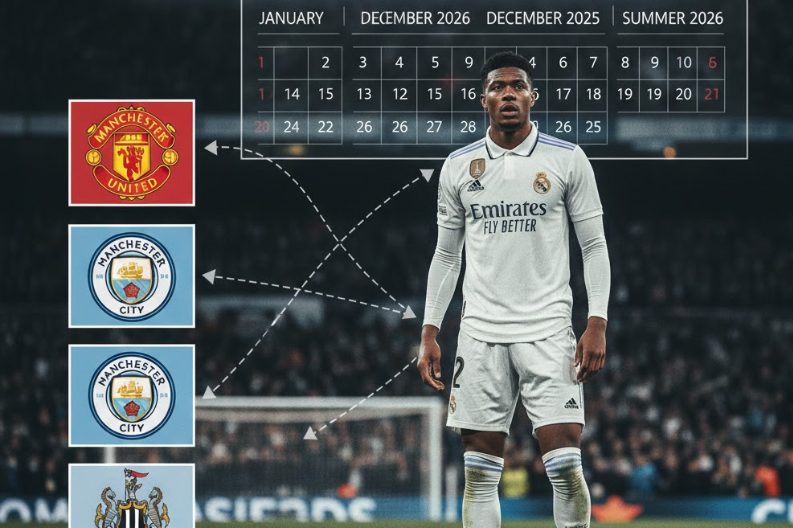

Alexander Arnold’s Real Madrid Future in Doubt as Premier League Clubs Circle

The football world is buzzing with speculation about Alexander Arnold and his challenging time at Real Madrid. The English defender made a controversial move from Liverpool to the Spanish giants last summer. However, things haven’t gone as planned for the 27-year-old.

Since joining Real Madrid, Alexander-Arnold has struggled to find his rhythm. He has made only 11 appearances across all competitions. Moreover, a quadriceps injury in December has sidelined him for several months. This lack of playing time has raised questions about his future at the Bernabéu.

Current Situation at Real Madrid

Several factors are contributing to the uncertainty:

- Limited game time with just 11 matches played

- Recent injury keeping him out for two months

- Difficulty adapting to Spanish football

- One assist recorded so far this season

Despite these challenges, both Alexander-Arnold and Real Madrid remain committed to each other. The player wants to stay and prove himself. Similarly, the club believes he needs more time to adapt.

Premier League Interest Growing

Nevertheless, three English clubs are monitoring the situation closely. Manchester United, Manchester City, and Newcastle United are all considering making offers. Reports suggest they might bid around €40 million for the defender.

For Manchester United, this move would be particularly controversial. Alexander-Arnold spent his entire career at Liverpool before joining Madrid. A transfer to United would cross one of football’s biggest rivalries.

Meanwhile, Newcastle United sees him as a valuable addition to their squad. They currently sit tenth in the Premier League and want to strengthen their defense.

Real Madrid’s Position

| Club Stance | Details |

|---|---|

| Current valuation | €40 million offers considered insufficient |

| Contract length | Runs until summer 2031 |

| Selling intention | No plans to let him leave |

| Club confidence | Believes in his potential |

Real Madrid paid a small transfer fee to Liverpool last summer. Any sale would generate significant profit for them. However, they have no intention of selling at this point.

What Happens Next?

The January transfer window has opened, but no immediate moves are expected. Instead, the summer of 2026 could be crucial. By then, Alexander Arnold will have had more time to prove himself in Spain. If things don’t improve, those Premier League clubs might return with stronger offers.

For now, everyone waits to see if the talented defender can overcome his struggles and establish himself at Real Madrid.

Daily News

Aaron Hardie Smashes 94 as Perth Scorchers End Hurricanes’ Home Winning Streak

Perth Scorchers delivered a powerful performance at Bellerive Oval, with aaron hardie playing a starring role alongside captain Mitchell Marsh. The duo put on a record-breaking display that ended Hobart Hurricanes’ impressive nine-match winning streak at home. Consequently, the Scorchers moved up to third place on the BBL points table.

Record-Breaking Partnership

Mitchell Marsh scored 102 runs off 58 balls, while Aaron Hardie remained unbeaten on 94 from just 43 deliveries. Together, they created the highest third-wicket partnership in BBL history with 164 runs. Furthermore, their explosive batting powered Perth to a massive total of 229 for 3 wickets.

Match Highlights

| Team | Score | Result |

|---|---|---|

| Perth Scorchers | 3-229 | Won by 40 runs |

| Hobart Hurricanes | 9-189 | Lost |

The turning point came during the final 10 overs. Perth scored an incredible 149 runs in that period. Additionally, they added 38 runs during the Power Surge overs, which completely changed the game’s momentum.

Hardie’s Explosive Performance

Aaron Hardie particularly dominated Chris Jordan in the 12th over. He smashed four boundaries and one six, helping his team collect 26 runs from that over alone. His innings included five massive sixes and showcased his ability to accelerate when needed most.

Mitchell Marsh praised Hardie after the match, saying he deserved the player of the match award. However, Marsh himself received the honor for his century.

Hurricanes’ Chase Falls Short

Despite a strong effort, Hobart Hurricanes couldn’t keep up with the required run rate. They lost opener Mitchell Owen cheaply once again. Subsequently, they lost both openers during the powerplay, putting them under immediate pressure.

Nikhil Chaudhary scored 31 off 15 balls, while captain Matthew Wade added 29 from 14 deliveries. The pair put together a fighting 56-run partnership. Nevertheless, their dismissals in quick succession ended any hopes of a comeback.

Key Factors in Scorchers’ Victory

- Marsh’s second BBL century (102 off 58 balls)

- Hardie’s unbeaten 94 off 43 balls

- Record 164-run partnership for third wicket

- 149 runs scored in final 10 overs

- Disciplined bowling in crucial moments

Impact on Tournament Standings

This victory gave Perth Scorchers their second consecutive big win. Moreover, it boosted their confidence as they secured third position on the table midway through the season. Their record now stands at three wins and two losses.

Meanwhile, Hobart Hurricanes remain second on the points table despite this loss. Their record of four wins and two losses still keeps them in strong contention.

The match proved that aaron hardie has become a crucial player for the Scorchers. His ability to finish innings with such power makes Perth a dangerous team heading into the second half of the tournament.

-

City Guide3 years ago

City Guide3 years ago3B2 Mohali Market Shops: Discover 44 Hidden Gems

-

Entertainment3 years ago

Entertainment3 years agoTop 15 Punjabi Models – Male and Female List

-

Entertainment3 years ago

Entertainment3 years agoTop 11 Punjabi Comedians of All Time

-

Jobs4 years ago

Jobs4 years agoTop 20 IT Companies in Mohali

-

Food4 years ago

Food4 years ago11 Best Restaurants in Mohali You Must Visit

-

Food3 years ago

Food3 years agoTop 15 Cafes in Mohali you must visit

-

Property2 years ago

Property2 years agoWho Lives In Homeland Mohali: Punjabi Celebrities, Business People…

-

Education2 years ago

Education2 years ago10 Famous Punjabi Writers With A Great Impact On The Literary World